Kenneth A. Welsh, 42, of River Edge, "used his position as an investment advisor to gain the trust of his victims," U.S. Attorney Philip R. Sellinger said.

"(He) then exploited that trust,” Sellinger said.

Welsh was working at Wells Fargo Clearing Services in Fairfield when federal authorities said he began shifting money from clients' accounts to that he controlled in July 2017.

Over the next four years, Welsh diverted $2,596,394 from five victims to credit cards held in the names of his wife and parents, federal authorities charged.

He also forged distribution request forms that produced $268,740 worth of cashier’s checks drawn against the victims’ brokerage accounts, a complaint on file in U.S. District Court in Newark says.

Some of the victims were elderly, it says, adding that none of them had any idea what was happening. At least one of them allegedly got a bogus statement that made it appear all assets were properly invested.

One of them, 78-year-old eye doctor Kenette Sohmer of Branchburg, lost $1,815,800 through 74 wire transfers from December 2018 through March 2021, the government said.

But that wasn't all: Two cashier's checks for $41,201 were also reportedly drawn from the victim's brokerage account.

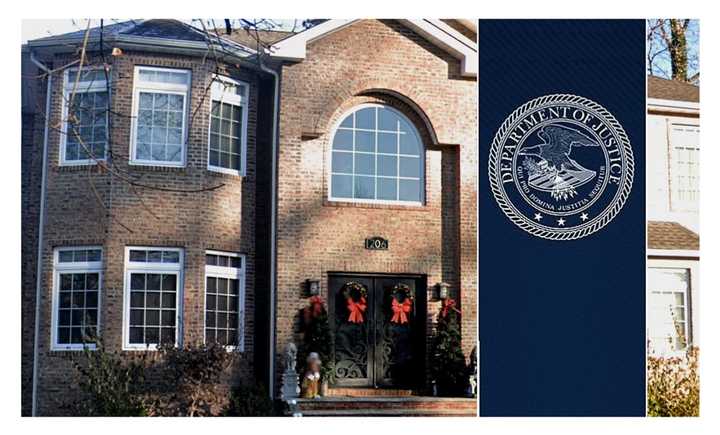

A suit filed by Sohmer says Welsh used $900,000 of her money to buy his five-bedroom home in River Edge (see photo, top).

Welsh began his career with Morgan Stanley nearly two decades ago before becoming a registered advisor with Wells Fargo in 2012, according to BrokerCheck.

Sellinger said Welsh began stealing five years later and kept it up through March 2021. Wells Fargo fired him that June.

Federal agents arrested Welsh in October 2021. That same day, the Securities and Exchange Commission filed a civil suit against him. It's still pending.

A grand jury was empaneled in U.S. District Court in Newark that returned a criminal indictment on Wednesday, Nov. 15, charging him with four counts of wire fraud and one of investment advisor fraud.

Sellinger credited special agents of the FBI with the investigation leading to the indictment, secured by Assistant U.S. Attorney Shontae D. Gray of his Economic Crimes Unit in Newark.

Welsh remains free pending a first federal court appearance.

Click here to follow Daily Voice Rutherford and receive free news updates.